How Beginners Can Build a Million-Dollar Stock Portfolio Step by Step is a practical roadmap for investors who want to grow long-term wealth through stocks rather than speculation. Building a million-dollar portfolio is not about timing the market perfectly but about discipline, consistency, and selecting the right stock types over time. Even beginners with modest capital can achieve this goal by following a structured investment process.

Stock investing rewards patience. By focusing on quality companies, reinvesting returns, and allowing compounding to work, beginners can steadily grow their portfolios across market cycles. Understanding stock types and risk management is essential before allocating capital

Set Clear Financial Goals and Time Horizon

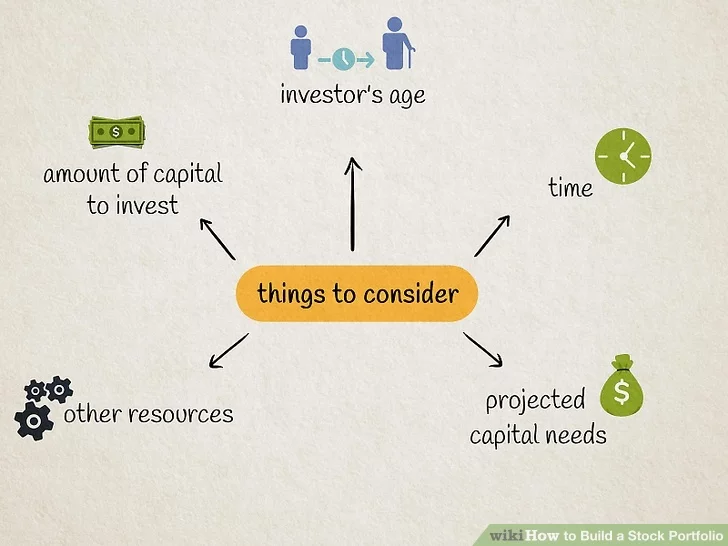

In How Beginners Can Build a Million-Dollar Stock Portfolio Step by Step, the first step is defining clear financial objectives. A million-dollar portfolio usually requires a long-term horizon of 15–30 years, depending on investment size and returns. Clear goals help investors stay committed during market volatility and avoid emotional decisions.

Beginners should determine monthly investment capacity, expected return range, and risk tolerance. These factors influence stock selection, portfolio structure, and rebalancing strategy over time.

Understanding stock types is critical in How Beginners Can Build a Million-Dollar Stock Portfolio Step by Step. Stocks generally fall into categories such as growth stocks, value stocks, dividend stocks, and blue-chip stocks. Each serves a different role in long-term wealth creation.

Growth stocks drive capital appreciation, dividend stocks generate passive income, and blue-chip stocks add stability. Beginners should combine these stock types to balance risk and reward while maintaining consistent portfolio growth.

Start With Blue-Chip and Index-Linked Stocks

A core principle in How Beginners Can Build a Million-Dollar Stock Portfolio Step by Step is starting with stable blue-chip and index-linked stocks. These companies have strong fundamentals, proven business models, and long histories of market leadership. They reduce downside risk while delivering steady long-term returns.

Index-linked stocks and ETFs provide instant diversification, protecting beginners from single-stock risk. Over time, this stable foundation allows investors to confidently add higher-growth opportunities.

Add Growth Stocks for Wealth Acceleration

Growth stocks play a vital role in How Beginners Can Build a Million-Dollar Stock Portfolio Step by Step by accelerating portfolio value. These companies reinvest profits to expand operations, develop technology, and increase market share. While they are more volatile, they offer higher long-term upside.

Beginners should limit growth stock exposure initially and increase it gradually as experience grows. Selecting companies with strong revenue growth, innovation leadership, and scalable business models improves success rates.

Reinvest Dividends for Compounding Power

Dividend reinvestment is a powerful strategy in How Beginners Can Build a Million-Dollar Stock Portfolio Step by Step. Instead of withdrawing dividends, reinvesting them purchases additional shares, accelerating compound growth. This strategy significantly boosts portfolio value over decades.

Dividend stocks also provide psychological stability during market downturns by generating income even when prices fluctuate. Over time, reinvested dividends can contribute a substantial portion of total returns

Maintain Consistent Monthly Investments

Consistency is the backbone of How Beginners Can Build a Million-Dollar Stock Portfolio Step by Step. Investing a fixed amount monthly through systematic investment plans reduces market timing risk and benefits from dollar-cost averaging. This approach smooths purchase prices across market cycles.

Even small monthly investments can grow into large portfolios when combined with time and compounding. Discipline matters more than starting capital.

Diversify Across Sectors and Industries

Diversification is essential in How Beginners Can Build a Million-Dollar Stock Portfolio Step by Step to manage risk. Investors should spread investments across sectors such as technology, healthcare, finance, energy, and consumer goods. Sector diversification reduces exposure to industry-specific downturns.

A well-diversified stock portfolio maintains growth potential while protecting capital during economic shifts. Rebalancing annually helps maintain optimal allocation.

Control Risk and Avoid Emotional Decisions

Risk management is a critical lesson in How Beginners Can Build a Million-Dollar Stock Portfolio Step by Step. Beginners must avoid chasing hype, panic selling, or overtrading. Emotional decisions often destroy long-term returns.

Using stop-loss limits sparingly, avoiding leverage, and focusing on fundamentals helps investors stay aligned with long-term goals rather than short-term noise.

Review and Rebalance the Portfolio Annually

Portfolio review ensures progress in How Beginners Can Build a Million-Dollar Stock Portfolio Step by Step. Annual reviews help identify underperforming stocks, rebalance asset allocation, and align investments with changing financial goals.

Rebalancing maintains proper exposure to growth, dividend, and defensive stocks without increasing unnecessary risk.

Final Thoughts:

How Beginners Can Build a Million-Dollar Stock Portfolio Step by Step proves that wealth creation through stocks is achievable with discipline, patience, and the right strategy. Success depends on understanding stock types, investing consistently, reinvesting returns, and staying committed during market cycles.

Beginners who focus on long-term fundamentals rather than short-term speculation give themselves the highest probability of achieving financial independence through stock investing.

Frequently Asked Questions (FAQ’s)