How to spot breakout stocks begins with understanding what a breakout actually means in the stock market. A breakout occurs when a stock price moves decisively above a key resistance level or below a major support level, usually accompanied by increased trading volume. This price action often signals the start of a strong upward or downward trend rather than a short-term fluctuation.

Breakout stocks attract both traders and long-term investors because they can deliver rapid price appreciation within a short period. Identifying these opportunities early allows investors to enter positions before institutional money fully drives prices higher.

Price Consolidation: The Foundation of Breakouts

How to spot breakout stocks requires careful observation of price consolidation phases. Before a breakout, stocks often trade within a narrow range for weeks or months, forming chart patterns such as rectangles, triangles, flags, or pennants. This consolidation represents a balance between buyers and sellers.

When price finally breaks above this range, it signals that buyers have gained control. Strong breakouts typically follow extended consolidation periods, making patience a key factor in breakout investing success.

Volume Expansion as a Breakout Confirmation

Volume plays a critical role in how to spot breakout stocks effectively. A true breakout is usually supported by a sharp increase in trading volume, indicating strong market participation. High volume confirms that institutional investors and large traders are entering the stock.

Breakouts without volume confirmation are more likely to fail. Monitoring average volume levels and comparing them to breakout-day volume helps investors avoid false signals and weak setups.

Identifying Key Resistance Levels

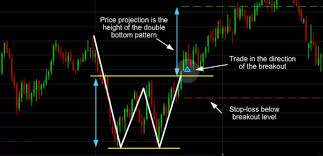

How to spot breakout stocks also involves identifying key resistance levels accurately. Resistance levels are price zones where stocks have previously struggled to move higher due to selling pressure. These levels can be identified using historical highs, trendlines, or moving averages.

When a stock decisively breaks above resistance, it often triggers buy orders, stop-loss exits from short sellers, and momentum trading activity. This combination can fuel sharp upward price movement.

Role of Moving Averages in Breakout Analysis

Moving averages are essential tools when learning how to spot breakout stocks. Stocks trading above rising short-term and long-term moving averages often show strong underlying momentum. Breakouts occurring above the 50-day and 200-day moving averages tend to have higher success rates.

Moving average crossovers can also signal trend shifts. When shorter moving averages cross above longer ones, it often precedes powerful breakout phases.

Fundamental Catalysts Behind Breakout Stocks

How to spot breakout stocks is not limited to technical analysis. Fundamental catalysts such as earnings surprises, revenue growth, new product launches, contract wins, or industry tailwinds often trigger breakouts. Stocks with improving fundamentals attract institutional investors, leading to sustained price momentum.

Combining technical breakouts with strong fundamentals increases the probability of long-term success. Investors should analyze earnings reports, guidance updates, and sector trends alongside chart patterns.

Sector Strength and Relative Performance

Sector performance plays a crucial role in how to spot breakout stocks early. Stocks tend to break out more successfully when their entire sector is outperforming the broader market. Sector strength provides additional momentum and investor confidence.

Relative strength indicators help compare a stock’s performance against market benchmarks. Breakout stocks that outperform indices before breaking out often lead rallies after confirmation.

Market Sentiment and Broader Trend Alignment

How to spot breakout stocks also requires understanding overall market conditions. Breakouts are more reliable during bullish or recovering markets where liquidity and investor confidence are high. In weak or volatile markets, breakouts may fail more frequently.

Aligning breakout trades with the broader market trend improves success rates. Investors should avoid aggressive breakout positions when indices are trending downward.

Risk Management When Trading Breakout Stocks

Risk management is essential when applying how to spot breakout stocks strategies. Even the strongest setups can fail due to unexpected news or market shifts. Setting stop-loss orders just below breakout levels helps limit downside risk.

Position sizing also matters. Allocating a controlled portion of capital to breakout trades protects portfolios from large losses while allowing participation in high-reward opportunities.

Common Mistakes Investors Make With Breakouts

Many investors misinterpret how to spot breakout stocks by chasing prices after extended moves. Late entries often lead to poor risk-reward ratios. Another mistake is ignoring volume confirmation or broader market context.

Emotional trading and overconfidence can also undermine breakout strategies. Successful investors remain disciplined, patient, and data-driven when executing trades.

Building a Consistent Breakout Stock Strategy

A consistent approach to how to spot breakout stocks involves scanning markets regularly, tracking potential setups, and waiting for confirmation. Using stock screeners, alerts, and watchlists improves efficiency.

Over time, investors refine strategies based on experience and performance analysis. Consistency, rather than frequency, leads to better breakout trading results.

Final Thoughts

Learning how to spot breakout stocks before they surge can significantly enhance investment performance when executed with discipline and proper analysis. Breakouts represent moments when market psychology shifts decisively in favor of buyers, creating opportunities for rapid price appreciation. By combining technical signals, volume confirmation, strong fundamentals, and risk management, investors can improve their ability to identify genuine breakouts while avoiding common pitfalls. Patience, preparation, and consistency remain the keys to long-term success with breakout stocks.

FAQ’S